Taxation 2017 in Geneva

Eric Duvoisin

The canton of Geneva is highly attractive to many businesses for various factors. This post will provide you with an overview of corporate taxation at federal and cantonal/municipal level in the canton of Geneva (1).

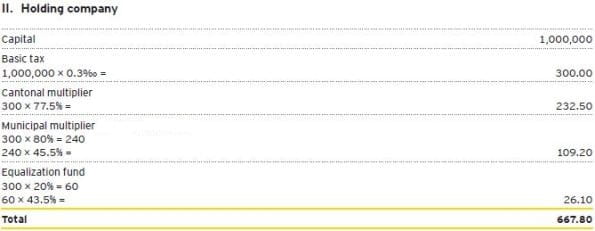

What are the profit corporate tax rates in Geneva ?

How can I calculate the tax burden for a company domiciled in Geneva with a net taxable profit of CHF 250,000?

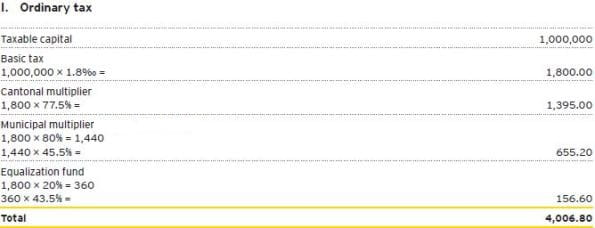

What is the capital tax rate in Geneva?

Cantonal tax levied on the base rate of 1.8‰ (total 4.007‰ in the City of Geneva*). In the absence of taxable profits, the base rate is 2‰ (total 4.452‰ in the City of Geneva*).

Holding companies are subject to a base rate of 0.3‰ (total 0.67‰ in the City of Geneva*) of their equity.

For new companies in the canton of Geneva, during the first three years of their existence, the cantonal multiplier is not applied and, accordingly, the aforementioned rates will be 1.8‰ (total 2.612‰ in the City of Geneva*), 2‰ (total 2.902‰ in the City of Geneva*), and 0.3‰ (total 0.435‰ in the City of Geneva*), respectively.

The base cantonal tax on capital is reduced by the amount of the cantonal base tax on profits (maximum CHF 8,500); this reduction only affects the cantonal multiplier on the capital (accordingly, a maximum reduction of CHF 15,087.50 in the City of Geneva*).

How can I calculate the capital tax for an ordinary taxed / holding company domiciled in the City of Geneva with a taxable capital of CHF 1,000,000?

Geneva is a very attractive place for working and living. The corporate profit and capital tax rates may – under certain circumstances - be also an attractive decision criterion for companies to keep their business in Geneva respectively move their business to Geneva.

# # #

* Subject to subsequent modifications.

(1) The information is based on the EY Tax 2017 Geneva brochure which gives a general overview of taxation in the canton of Geneva taking into account 2017 rates, unless otherwise indicated.